With Federal financial aid data undergoing critical changes, do not assume you can continue to do what you have always done. Systems and data integrations build up over time. We continually work towards the goal of enhancing student and staff experiences, breaking down barriers whenever possible. In these iterative product lifecycles, there come times to pause, reassessing which data points are shared and why. This happens to be one of those times.

At this years Federal Student Aid Training Conference, the Department of Education spent time in Breakout Session #10 to discuss Data Use and Considerations under the FUTURE Act and FAFSA Simplification Act.

These Acts are redefining how data points are being classified. In the past some data transmitted to institutions on the ISIR was considered “FAFSA Data.” However, beginning with the 2024-25 cycle this is no longer the case with Federal Tax Information (FTI). The reclassification further restricts how institutions can use and share the information. Including not just the raw FTI information, but derived data as well. To fully understand how these changes impact your processes and procedures, be sure to review and discuss these changes with your team.

One specific area you will want to consider is any integrations between your Student Information System (SIS) and Constituent Relationship Management system (CRM). You may be bringing in information for email blasts, calling campaigns, or more. Be sure to review each datapoint related to financial aid.

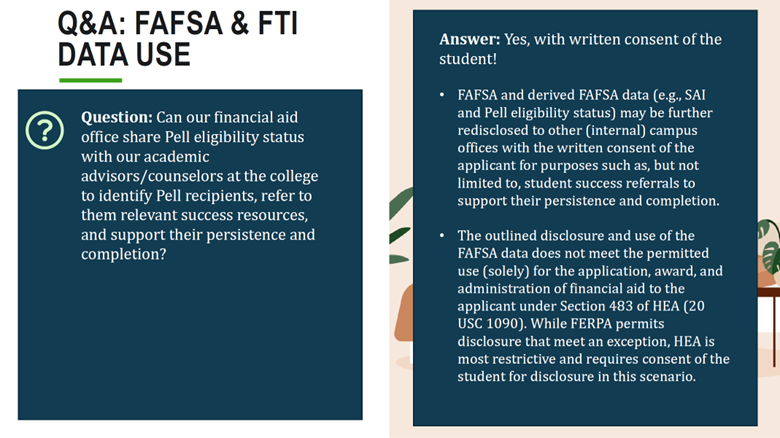

You may have the noble goal of trying to provide additional resources for students in demographic groups that historically have faced additional academic performance challenges at your institution such as Pell eligible students. Under the new regulations this would require each individual student to first provide written consent.

Data Use and Considerations

As you can see, from the image above, some data can still be used by areas outside of Financial Aid. However this information will require the student first providing written consent. Additionally, it must be specific consent; general consent for any purpose will not be accepted.

You may have undertaken data sharing to help best assist and support students. Thinking about Admission, Retention, Counseling, and other areas of an institution may currently have access to an array of Financial Aid related data; you will need to take a step back to assess what are the datapoints and do they require redacting or the additional step or prior written consent?

Many of our clients’ financial aid offices are already going through a tremendous amount of change in the 2024-25 cycle, this is yet another area which will require their attention.

Risks of Misusing Federal Tax Information

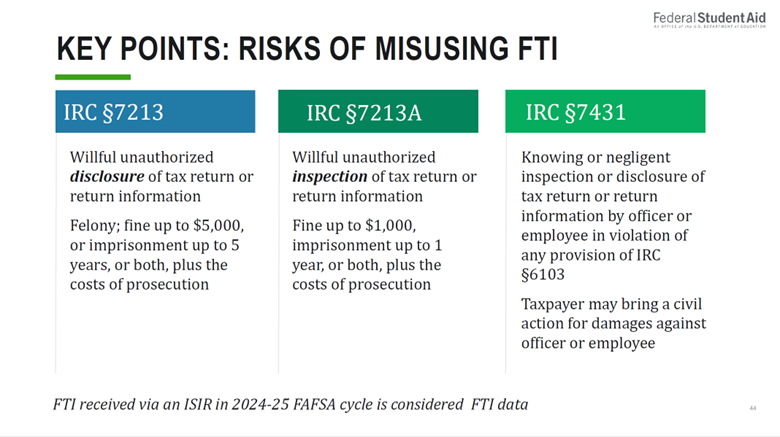

You may be wondering if there are risks with not preforming a thorough review nor addressing the changing regulations. In addition to the standard concerns of audit findings, the Department of Education was clear to point out the statutes and repercussions associated with misusing Federal Tax Information.

When your financial aid team downloads federal data they do so through the SAIG system. This year there is a new agreement when they setup. In the updated agreement, there are stipulations around data security, one of which states:

“My organization has ensured the standards for protecting federal tax information (FTI) have been implemented according to Internal Revenue Code (IRC) 26 U.S.C. 6103 – Confidentiality and disclosure of returns and related information and pursuant to 20 U.S.C. 483 of the Higher Education Act, as amended – Use of FAFSA and FTI data. I further acknowledge violations of the IRC may lead to criminal and/or civil penalties pursuant to 26 U.S.C. 7213; 7213A; and 7431. Penalties apply to willful unauthorized disclosure and inspection of tax return or return information with punishable fines or imprisonment. Additionally, I further acknowledge a taxpayer may bring civil action for damages against an officer or employee who has inspected or disclosed, knowingly or by reason of negligence, such taxpayer’s tax return information in violation of any provision of IRC 6103.”

Institutions should discuss these items with their President, General Counsel, Director of Financial Aid, CIO, CISO, and other impacted parties to determine how to best move forward. These requirements could add additional layers of security surrounding the impacted data points and adjustments to current/planned integrations.

There is no option to “opt-out” of these new regulations if your institution processes Federal Financial Aid. The 2024-25 cycle is full of changes. This blog addresses just one. To learn more about new financial aid requirements or how we could help your institution navigate these changes, please contact us today.

About the Author:

Jim Olick is a senior consultant with SIG. He is a higher education enrollment management professional at the nexus of admissions, financial aid, data analysis, and technology. You can find Jim on LinkedIn at https://www.linkedin.com/in/jimolick/.

RESOURCES provided by the Department of Education

May 12, 2023, Electronic Announcement:

Access and Use of Federal Tax Information (FTI) for Federal Student Aid Programs Beginning with the 2024-25 FAFSA Processing Cycle

March 2023, An Eligible Student Guide to the Family Educational Rights and Privacy Act (FERPA)

BO10. Data Use and Considerations Under the FUTURE Act and FAFSA® Simplification Act