In higher education, accounts receivable (AR) is a vital step in the month/year end closing process. Auditors may trace transactions from a sub ledger to the general ledger, and follow the trail to the financial statements, to make sure transactions are being recorded properly in your Banner environment.

To support your month end process, SIG has put together a short, but crucial checklist to handle your institution’s AR reconciliation using Banner.

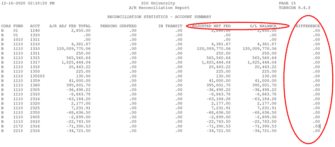

1. Run TGRRCON daily in Reconciliation Mode. The TGRRCON report should be run after the nightly feed AR jobs stream (TGRFEED > FURAPAY (Student Refunds) and FURFEED > FGRTRNI/FGRTRNR > Posting or Incomplete Feed Document). Review the RECONCILIATION STATISTICS – ACCOUNT SUMMARY section of the report to review the ADJUSTED NET FED to G/L BALANCE DIFFERENCES.

Note: Reconciliation Mode Parameters. No Miscellaneous Transactions with Deposits.

2. Start a daily TGRRCON comparison spreadsheet to freeze the out of balance at a date so you can track daily changes that are easier to research.

3. React to any changes to the Adjusted Net Fed and G/L Balance comparison in the RECONCILIATION STATISTICS – ACCOUNT SUMMARY section of TGRRCON.

4. Research out of balance issues using AR Query TGIACCD and Finance Query FGIGLAC to reconcile the current feed documents from AR to Finance General Ledger (GL) DIFFERENCE column on TGRRCON. The application of payments feed documents should never be the issue.

5. Analyze the feed(s) for AR to GL and change either the detail code(s) or JV any non-AR fed transaction in corresponding the GL.

If your institution needs more guidance, SIG can provide solutions to help streamline your AR reconciliation process.